There are many tasks that we outsource to experts and professionals: car maintenance, house renovation, tax filing, and even something as simple as getting a haircut. If we order from a restaurant (most likely take-out nowadays) we’re outsourcing our cooking tasks. The reason we struggle to learn and invest on our own lies in what I just said above about outsourcing.

And we struggle with how to invest on our own because the stakes are higher. If your barber gives you a bad haircut, your hair will grow back eventually. But if your investments tank due to an ill-fitting position, it may jeopardize a goal tied to your money, such as a vacation, a house purchase, or worse, your retirement.

However, like any trade or skill, investment management is something that requires years of practice. Investment managers typically have backgrounds in economics, human behavior, financial markets, and history. Not only does it require the study of these concepts, but also the keeping track of market developments and how investors change their narratives. To be properly diversified, an investor needs to have spread positions across regions, asset classes, and currencies. All this can be too much for a single person.

With that in mind, there are two ways that you can hire an investment expert, or to be accurate, an investment team. If the amount of money you’re investing is Php1million or higher, you can go to your preferred bank and open an Investment Management Account (IMA). Ideally, there would be a detailed discussion on what your goals and restrictions are for the money and they will invest it for you according to your customization. Another way, which doesn’t require that much amount of savings (one can now invest for as low as P50!), is investing through pooled funds.

Pooled funds, as you would have guessed from its name, pools the money from a group of people and invests it accordingly. Unlike the IMA which is customized, the way the fund is managed and invested is dependent on the specific fund that you get. You can think of IMA as getting a tailored suit while a pooled fund is like buying an off-the-rack suit. Fortunately (or unfortunately) it is 2021, and there are now a lot of choices for pooled funds!

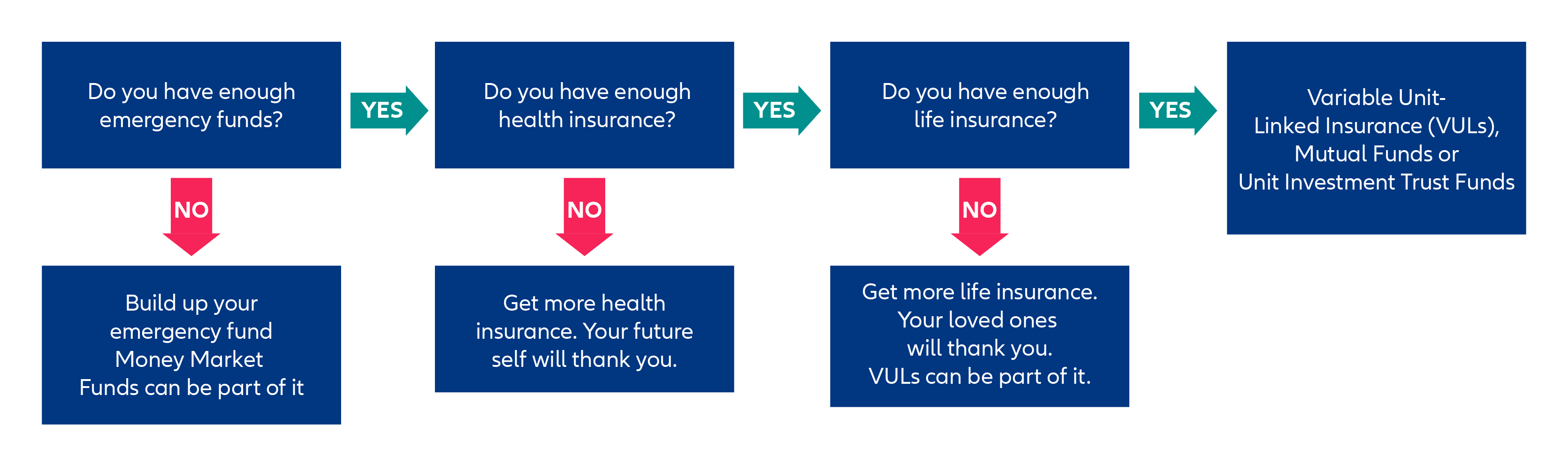

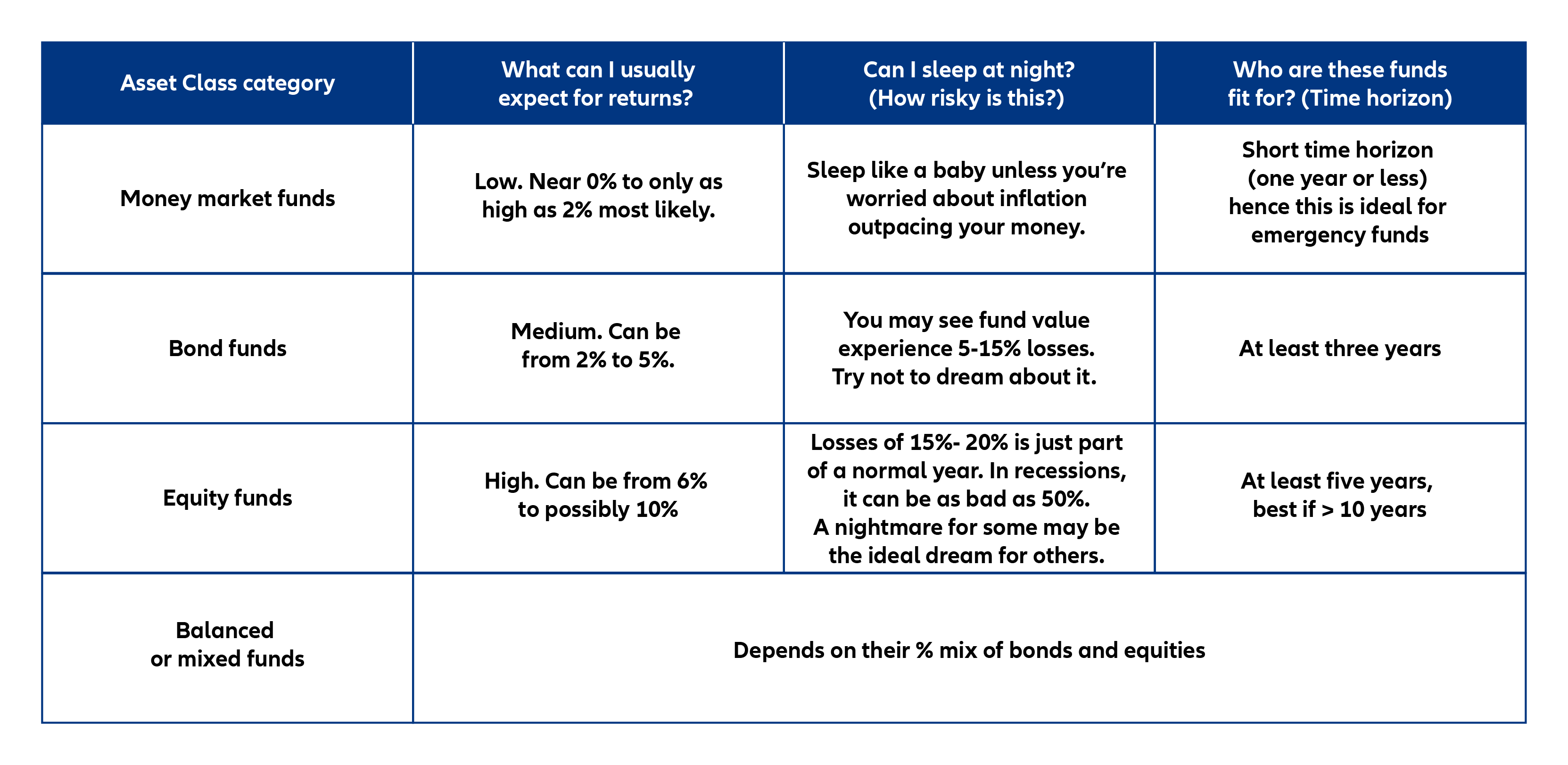

Choices? Oh no. How do I choose? The problem that we have now is how to choose since there’s an overwhelming number of alternatives. I made the guide below to help you navigate.