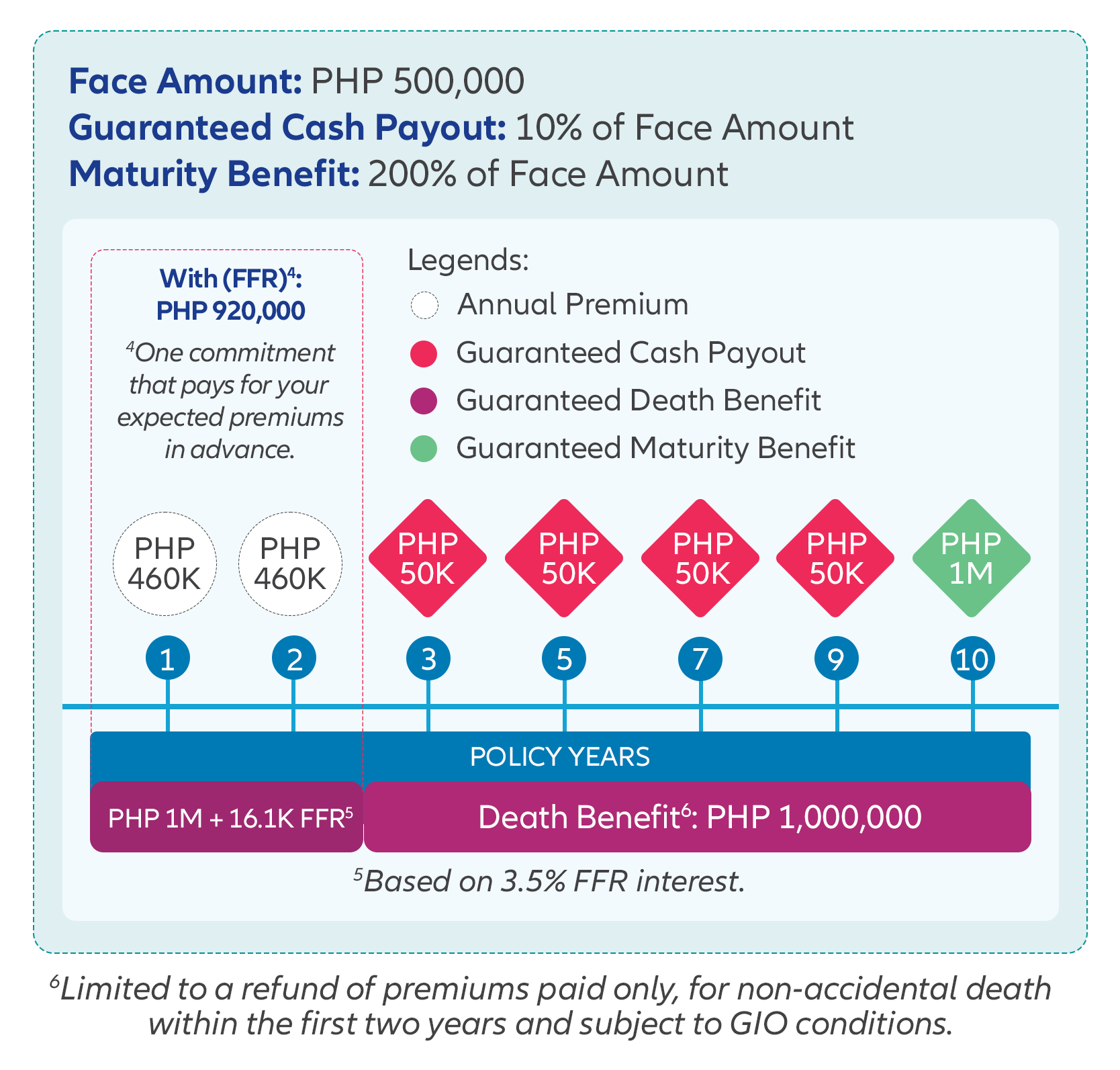

Allianz Secure Payout 10 is a 10-year endowment plan with a convenient 2-year payment period. Enhanced with our Flexi-Fund Rider, it offers the ideal balance of guaranteed benefits, life insurance protection, and long-term financial security.

A Guaranteed Plan That Protects and Rewards You!

With the Guaranteed Insurability Offer, no medical exams are required, ensuring a seamless and stress-free application process. This plan is designed for individuals looking to grow their savings while securing their family’s future, without the risks and volatility of market-linked investments.

Guaranteed Insurability Offer

No medical exams and fewer documents required with Guaranteed Insurability Offer (GIO)¹ so that you can quickly get the protection you deserve.

¹Subject to GIO conditions.

Guaranteed Cash Payout

Receive 10% of the Face Amount at the end of the 3rd, 5th, 7th, and 9th policy years² so you can confidently enjoy life's moments while keeping your savings intact.

²Provided that the insured is alive.

Guaranteed Maturity Benefit

Get up to 200% of your Face Amount³—a benefit you can use to complement your dream retirement or pass down to your grandchildren.

³Face Amount ranges from PHP 500,000 to PHP 15 Million.

Receive steady gains for guaranteed growth!

Here is a sample illustration based on the minimum annual premium of PHP 460,000:

Peace of Mind

Gain peace of mind with a Guaranteed Death Benefit6 equal to 200% of your plan’s Face Amount

Year 10 Maturity Benefit

Receive guaranteed 200%3 of your Face Amount as maturity benefit in the 10th year, which you can maximize for a more comfortable future.

Guaranteed Cash Payout

Enjoy cash benefits equivalent to 10% of your Face Amount at the end of the 3rd, 5th, 7th, and 9th policy years2.

Flexible Payment

Settle your two-year premiums upfront in one commitment and earn a non-guaranteed interest with your second-year premium with our Flexi-Fund Rider (FFR)7.

7Terminates automatically once the two-year premium is fully paid.

Hassle-Free Process

Secure coverage quicker and easier with Guaranteed Insurability Offer (GIO)1, with fewer documents required to get covered.

Get more from your well-planned protection!

Flexi-Fund Rider (FFR)

Pay your premiums upfront and enjoy automated payments, as you earn up to 3.5% non-guaranteed interest with the Flexi-Fund Rider (FFR)7 for your second-year premium.

Minimum Premium

Build your future with a minimum annual premium of PHP 460,000 or a one-time commitment of PHP 920,000 with the FFR.

Cash Value

In cases of emergency, you have the flexibility to surrender your policy and collect the cash value8.

8Subject to terms and conditions.

DISCLAIMER

This is not a deposit product. Earnings are not guaranteed, and the principal amount may be subject to risk of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained. If you do not fully understand this product, do not purchase or invest in it.

Allianz PNB Life is an affiliate of Philippine National Bank. Financial Products of Allianz PNB Life are not insured by the Philippine Deposit Insurance Corporation and are not guaranteed by Philippine National Bank.