Fuel your aspirations while addressing your financial requirements with AZpire Growth. This flexible savings and investment plan allows you to save for your future and grow your money at the same time.

Reach Your Financial Dreams With Our Flexible Savings and Investment Plan

Set Your Terms

With AZpire Growth, you can pay your premiums annually, semi-annually, quarterly, or monthly depending on your current financial situation. You can also pay your premiums in Philippine Peso or switch to a US Dollar-denominated plan.

Grow Your Money Faster

You can increase your investments to grow your money faster. Whether you want to top-up your investments regularly or have extra money that you want to grow, AZpire Growth is the policy for you.

Exceptional Protection

AZpire Growth is a flexible savings plan that comes with insurance. When you obtain this policy, you can be at peace knowing you’re covered by life insurance equivalent to 5x your annual premium.

Protection for Life at the Highest Levels

Enjoy the protection you need until age 100 at 5x or 500% of your annual premium with this flexible savings plan with insurance.

Pocket-Friendly Payment Terms That You Control

You can choose to pay your premiums annually, semi-annually, quarterly, or monthly. If your fund values are more than enough to cover your monthly charges after the 5th year, you can elect not to pay premiums anymore.*

Ability to Level-Up as You Like

Whether you like to top-up your investments regularly or when you have more cash available than you need, AZpire Growth allows you to level up your investments. Boost your flexible savings and investment plan so you don’t have to take out new policies or investment instruments.

Funds You Can Easily Manage

You have the freedom to switch your plan’s investment. Enjoy up to 4 switches a year free of charge.

Account You Can Access as Needed

You can withdraw from your funds anytime, subject to applicable charges and maintaining balance. If you withdraw twice a year in the 5th policy year onward, each transaction will be free of charge.

A Premium for Persistence

On your 10th and 20th policy year, you can receive 5% of your 10-year average monthly balance. These bonuses will be credited to your account. You can also get an additional 2% on your regular premium on years 6 through 20, provided all premiums have been paid and no withdrawals have been made in the same period.

The premium bonuses are available for withdrawal after 15 years from issue or at maturity, whichever comes first.

Riders To Rev Up Your Plan

Don’t stop with coverage that’s at 500% of your annual premiums. Power up your plan further with Critical Illness 100, Total and Permanent Disability, and Accidental Death and Dismemberment Riders.

Access to Allianz Healthbox perks

Allianz Healthbox is your one-stop shop access to our health, lifestyle, and wellness partners nationwide.

Enjoy exclusive freebies and discounts to achieve your health and wellness goals.

Introducing: Payor’s Benefit Rider

This rider keeps your policy active by waiving all remaining expected premiums due if the payor of the plan suffers total and permanent disability or passes away. Talk to your Life Changer today to learn more!

DISCLAIMER

Like all other financial products, VULs have their advantages and trade-offs. As a unit-linked insurance product, the policy holder must understand and realize that the product is subject to certain risks, such as, but not limited to investment, credit, interest rate, liquidity, mark-to-market, regulatory, and taxation risks, which would affect the account or fund value of the whole VUL policy.

Allianz PNB Life Insurance Inc. is guided by the investment policies approved by the Insurance Commission (IC) including the IC-issued “Guidelines on Variable Life Insurance Contracts”. The supervision and regulation by the IC, however, does not guarantee the investment returns or protection of the VUL policy against capital loss.

For better understanding of the nature of the aforementioned risks, a table of Definition of Risks is provided in the Sales Illustration.

This is not a deposit product. Earnings are not assured and principal amount invested is exposed to risk of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained. If you do not fully understand this product, do not purchase or invest in it.

Like all other financial products, VULs have their advantages and trade-offs. As a unit-linked insurance product, the policy holder must understand and realize that the product is subject to certain risks, such as, but not limited to investment, credit, interest rate, liquidity, mark-to-market, regulatory, and taxation risks, which would affect the account or fund value of the whole VUL policy.

Allianz PNB Life Insurance Inc. is guided by the investment policies approved by the Insurance Commission (IC) including the IC-issued “Guidelines on Variable Life Insurance Contracts”. The supervision and regulation by the IC, however, does not guarantee the investment returns or protection of the VUL policy against capital loss.

For better understanding of the nature of the aforementioned risks, a table of Definition of Risks is provided in the Sales Illustration.

This is not a deposit product. Earnings are not assured and principal amount invested is exposed to risk of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained. If you do not fully understand this product, do not purchase or invest in it.

* When your Total Fund value is insufficient to cover all monthly charges, before or after your chosen premium holiday option, if any, you will be required to pay additional premiums, to keep your policy in force.

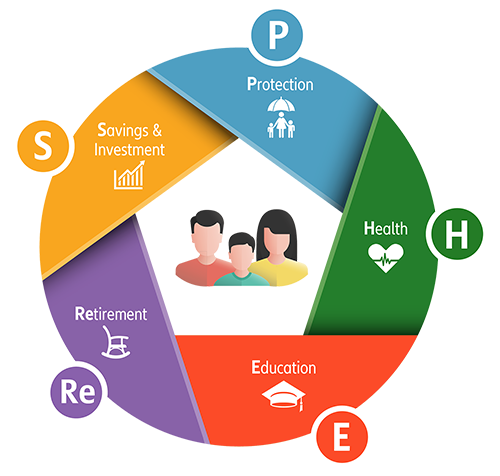

Financial Needs Analyzer

Find the right insurance plan for you!