Allianz Guru Series by Henry Yang: Let's Talk About Investment Risk

Let’s sit down and talk about risk. In simple terms, risk is the possibility of something bad happening. It exists in most of the things that we do. It is quite challenging identifying things that are risk-free, and typically, they are the most conservative options that may miss out on opportunities.

There are two ways we can deal with risk: mitigate it or accept tolerable levels of it.

Mitigating Risk

Managing risk can be done by preventing something from happening. Checking your car condition before a long drive is a good preventive practice. We can also prevent a lot of chronic diseases like diabetes, heart disease, or cancer by having at least 150 minutes of physical activity each week.

Another way to keep risk in control is to lower its impact in case it does occur. From the two examples above, in case of a car accident or health problem, having a car or health insurance may save you from out-of-pocket expenses. Having an insurance can help you get through tough times easier than recovering from a total disaster.

Accepting Tolerable Levels of Risk

Some of the models used by bankers and traders are inspired from professional gamblers. In a game where the house has an advantage, professional gamblers have devised methods to adjust their position levels and avoid ruin. For us commoners, the lesson is simple: take risks that will not ruin us.

For investors, it means assessing our cashflow schedule. When do we expect money coming in? When do we expect to pay for big ticket items? Easy rule to follow is not to invest money that you will be needing for at least 5 years. However, the average market cycle can last between five and 12 years, so it’s always best to look at a long-term horizon when you make investments.

READ MORE: The Market Cycles and the Matrix (Yes, the Movie Trilogy!)

Another way to assess if the risks we are taking are within tolerable levels is to look at typical volatility of the asset class that we are looking to invest in. Volatility is a complicated word to throw around. When simplified, it is the change in price that can normally happen in a year. A fund with 20% annual volatility means it’s normal to experience between -20% loss to +20% gain within a year’s time. It can be higher or lower and the usual estimate to gauge an extreme scenario is to multiply it by 2.58.

Below are popular asset classes, their volatility estimates, and estimated worst case losses for your guide.

Swipe to view more

| Volatility | Estimated Extreme Scenario | |

| Global Government Bonds | 6.8% | 18% |

| Emerging Markets Government Bonds | 10.2% | 26% |

| Global Equities | 16.6% | 43% |

| Asia Equities (Excluding Japan) | 20.1% | 52% |

*2023 Long-Term Capital Market Expectations by JP Morgan Asset Management

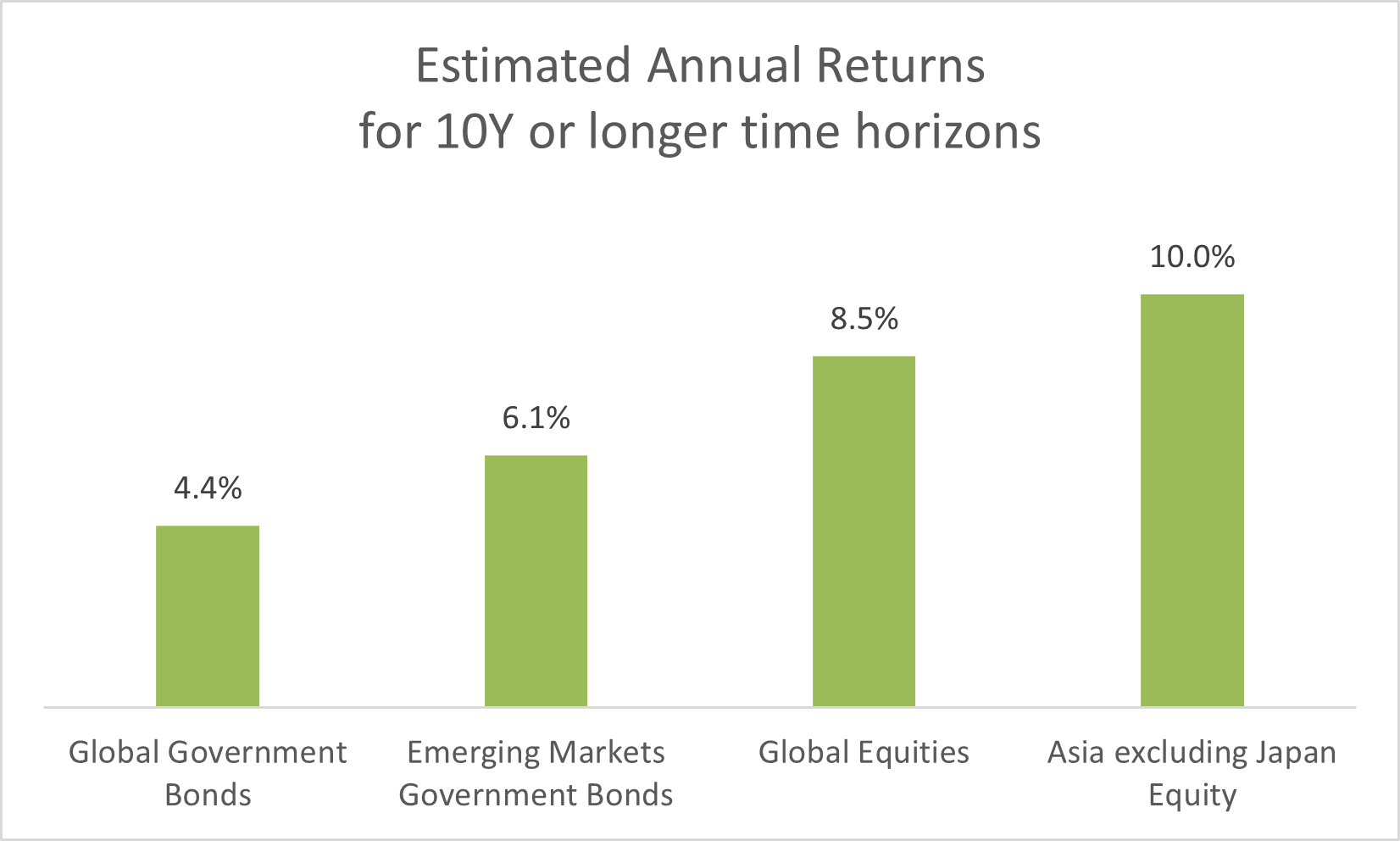

Looking at risks alone is an incomplete picture. Below are long-term expected returns from JP Morgan Asset Management. Notice that the higher the risks from the above table, the higher the return potential turns out to be.

Actual Example to Illustrate

Swipe to view more

| Fund Performance | |

| 2012* | 6% |

| 2013 | 22% |

| 2014 | 4% |

| 2015 | -2% |

| 2016 | 8% |

| 2017 | 24% |

| 2018 | -9% |

| 2019 | 27% |

| 2020 | 16% |

| 2021 | 19% |

| 2022 | -16% |

*Not Complete Year

If above terminologies sound too complicated, I hope that the following example paints a clearer picture. Suppose we invested $1,000 in Global Equities starting November 2012. By the end of 10 years, the value is at $2,360, which is an equivalent to an annual return of 9.0% (close to Estimated Annual Return of 8.5% for Global Equities).

Look at the Fund Performances per year, they vary but more or less within the range of +/- 43% (our Estimated Extreme Scenario.

Finally, note that even though this positioned gained 9% annually, it wasn’t a smooth ride. The value of your investments fluctuates. At times it would go up, from $1,000 all the way up to $1,420. Then, there are huge swings every now and then: from $1,420 to $1,171; from $2,093 to 1,428; and even the recent market correction that we’re having from $2,839 down to $2,360.

The key question before you invest is, “Can I keep on holding these positions knowing it would be a rollercoaster ride?”

Risk and Opportunity Are Opposite Sides of the Same Coin

Taking the risk-free way may not be the best route for everyone. If we take too little risk, it may be a 100% loss vs inflation (which is a huge concern right now). We may also miss out on maximizing our potential. Nobody wants to look back in time and wonder “What if…?”

That is why it is valuable to understand risks. What risks can we manage? What risks can we take head on? Let us stop avoiding talking about risk, and instead, open our eyes to opportunities that we can take and prepare for undesirable possibilities.

Henry Yang